Don’t overlook the benefits of solid offshore trusts asset protection strategies.

Recognizing Offshore Count On Possession Protection: Solutions to Guard Your Assets

If you're looking to protect your riches, comprehending offshore count on possession security is important. These counts on can offer an efficient shield against lenders and lawful cases, guaranteeing your possessions stay secure.

What Is an Offshore Trust Fund?

An offshore trust is a lawful plan where you put your properties in a trust managed outside your home nation. When you develop an offshore trust, you designate a trustee that oversees the properties according to your specified terms.

You can select different kinds of offshore counts on, such as optional or set trusts, based on your financial goals. In addition, you can mark beneficiaries that will obtain the trust's properties in the future.

Benefits of Offshore Trust Funds for Property Protection

An additional substantial benefit is tax obligation effectiveness. Depending upon the jurisdiction, you might benefit from beneficial tax therapies, which can aid you maintain even more of your riches. Offshore counts on can likewise offer flexibility regarding property monitoring and distribution, enabling you to customize the trust to your specific demands and objectives.

Kinds Of Offshore Trust Funds

When taking into consideration overseas depends on, you'll come across different types, mainly revocable and irrevocable trusts. Each serves various objectives and uses distinctive degrees of possession protection. Additionally, recognizing optional and non-discretionary depends on is necessary for making notified decisions about your estate preparation.

Revocable vs. Irreversible Counts On

Recognizing the differences in between revocable and irrevocable trust funds is vital for any person thinking about offshore asset defense. A revocable count on permits you to maintain control over the possessions, allowing you to modify or liquify it anytime.

On the other hand, an irreversible trust fund removes your control when developed, making it much more safe and secure from creditors. You can't transform or revoke it without the permission of the recipients, which offers stronger property protection. Choosing in between these kinds depends on your financial goals and take the chance of resistance, so weigh the pros and disadvantages meticulously before choosing.

Optional vs. Non-Discretionary Trust Funds

Discretionary and non-discretionary trusts offer various functions in offshore property defense, and understanding which type fits your demands can make a substantial difference. In a discretionary trust fund, the trustee has the adaptability to make a decision how and when to disperse possessions to beneficiaries. Ultimately, recognizing these differences aids you customize your overseas trust fund method to efficiently safeguard your properties and accomplish your financial objectives.

Key Providers Provided by Offshore Trust Service Providers

Many overseas trust suppliers provide an array of important solutions designed to secure your assets and assurance conformity with international guidelines. One key service is possession management, where professionals manage your investments to make best use of returns while reducing dangers. They additionally provide depend on management, ensuring your depend on runs smoothly and complies with lawful needs.

Tax planning is one more critical service, assisting you enhance your tax obligation situation and prevent unneeded responsibilities. In addition, these companies commonly supply estate planning assistance, directing you in structuring your depend fulfill your lasting objectives and safeguard your heritage.

Finally, many offer reporting and compliance services, ensuring you satisfy yearly filing needs and preserve transparency with regulatory bodies. By making the most of these services, you can boost the defense of your properties and attain tranquility of mind recognizing that your monetary future remains in qualified hands.

Choosing the Right Jurisdiction for Your Offshore Trust

When picking the best territory for your offshore trust, you need to ponder the asset protection legislations, tax ramifications, and the general reputation of the location. Each territory provides distinct benefits and obstacles that can substantially impact your trust's performance. By recognizing these elements, you can make a more enlightened choice that aligns with your economic objectives.

Jurisdictional Property Security Laws

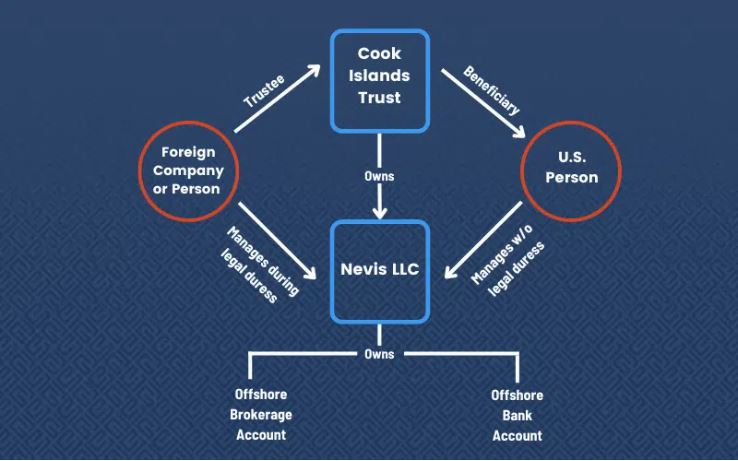

Picking the ideal jurisdiction for your overseas count on is vital, as it can greatly influence the level of property security you receive. Various jurisdictions have differing asset defense laws, which can secure your possessions from creditors and lawful claims. Try to find countries with solid legal frameworks that focus on count on personal privacy and offer favorable guidelines. Consider jurisdictions recognized for their robust monetary systems, like the Cayman Islands or Nevis, as they provide a strong lawful foundation for property security. Validate the chosen place has laws that stop forced heirship insurance claims and enforce restrictions on lenders. By thoroughly investigating and picking the best jurisdiction, you can improve the security of your possessions and appreciate comfort.

Tax Ramifications and Advantages

Just how can understanding tax obligation ramifications enhance the benefits of your offshore count on? By picking the best jurisdiction, you can potentially minimize your tax responsibility and optimize your possession defense. offshore trusts asset protection. Some overseas locations provide positive tax rates or also tax exemptions for depends on, enabling your properties to grow without hefty taxes

Furthermore, comprehending regional tax legislations can aid you structure your depend on efficiently. You'll wish to think about exactly how revenue generated by the trust fund is strained and identify any reporting requirements.

Legal Security and Track Record

As you explore choices for your overseas trust fund, comprehending the lawful security and credibility of prospective jurisdictions is important. A jurisdiction with a solid legal structure warranties your possessions are protected and much less vulnerable to political or economic instability. Examine the country's legislations pertaining to possession security and trust fund monitoring; some jurisdictions provide favorable guidelines, while others may have limiting techniques.

Credibility issues also. Search for well-regarded jurisdictions understood for their transparency, security, and strong economic systems. Research study just how these countries handle international cooperation and compliance with global regulations. This diligence will help you choose a location that not only safeguards your assets yet likewise offers peace of mind for the future. Ultimately, an audio selection improves your depend on's efficiency and protection.

Lawful Factors To Consider and Conformity

While establishing an offshore trust can provide substantial possession protection benefits, it's crucial to navigate the intricate legal landscape with care. You'll require to recognize the laws controling rely on both your home country and the jurisdiction where the count on is established. Compliance with tax laws is necessary, as falling short to report offshore accounts can lead to serious charges.

Furthermore, you ought to be conscious of global treaties and arrangements that might influence your trust fund's operations. Each country has distinct needs for documentation, reporting, and governance, so you'll desire to talk to lawful and financial consultants experienced in offshore trust funds.

Remaining compliant best site isn't almost avoiding lawful problems; it additionally assures that your properties are secured according to the legislation. By prioritizing lawful considerations and conformity, you safeguard your wide range and maintain satisfaction as you navigate this detailed procedure.

Steps to Developing an Offshore Depend On

Establishing an overseas depend on includes numerous key steps that can aid enhance the procedure and ensure your possessions are legally secured. You'll need to choose a reliable territory that provides beneficial laws for possession defense. Research numerous nations and think about elements like tax obligation ramifications and legal stability.

Following, choose a credible trustee. This could be a banks or an individual skilled in taking care of depends on. Ensure they comprehend your objectives and can follow regional laws.

As soon as you have actually selected a trustee, you'll compose the count on record. This must information your purposes and define recipients, assets, and this link distribution approaches. Consulting with a legal expert is vital to make sure your file meets all requirements.

Regularly Asked Concerns

Can I Set up an Offshore Trust Fund Without a Monetary Expert?

You can set up an offshore trust fund without a monetary advisor, however it's dangerous. You might miss out on important legal demands or tax obligation effects. Research study thoroughly, and take into consideration seeking advice from specialists to guarantee every little thing's done appropriately.

Just how much Does It Price to Keep an Offshore Depend On Each Year?

Preserving an offshore trust annually can cost you anywhere from a couple of hundred to several thousand bucks. Elements like territory, intricacy, and trustee costs influence these costs, so it's important to spending plan accordingly.

Are Offshore Counts On Just for Wealthy Individuals?

Offshore depends on aren't just for wealthy individuals; they can profit anybody aiming to shield properties or prepare for the future. They provide personal privacy and flexibility, making them easily accessible for a more comprehensive series of financial circumstances.

What Occurs if I Modification My Mind Regarding the Trust?

If you transform your mind about the count on, you can commonly customize or revoke it, depending upon the trust fund's terms. offshore trusts asset protection. Talk to your lawyer to ensure you follow the right legal treatments for adjustments

Can I Accessibility My Assets in an Offshore Trust Fund at any moment?

You can't access your properties in an offshore depend on at any moment. Normally, these trusts restrict your control to protect assets. You'll require to adhere to the count on's guidelines to access funds or home.

Verdict

To sum up, comprehending overseas count on property protection can be a game-changer for securing your riches. By capitalizing on specialized services and choosing the right jurisdiction, you can click for more info successfully shield your properties from lenders and legal claims. Bear in mind, establishing an offshore trust isn't practically protection; it has to do with guaranteeing your economic future is secure. So, take the following actions today to explore how an overseas trust can benefit you and your enjoyed ones.